Accounting firm

Reliable tax

compliance support

We ensure businesses stay compliant with evolving tax regulations while minimizing liabilities and maintaining financial accuracy. Our expert team manages essential filings, monitors tax obligations, and streamlines compliance processes, allowing you to focus on your core operations without the stress of navigating complex tax laws.

With our dedicated support, you gain confidence in meeting deadlines, reducing risks, and optimizing tax strategies tailored to your business needs. Whether handling corporate taxes, VAT, or other regulatory requirements, we provide the expertise and precision needed to keep your financial affairs in order.

Outsourced back office services

Managing your financials should never be a burden. Our services deliver accurate financial records, streamlined processes, and real-time insights, ensuring your operations run smoothly. By leveraging our expertise, we handle everything from daily transaction management to financial reporting allowing you to focus on what matters most: growing your business.

Our services include:

- General Bookkeeping – We take care of daily transactions, reconcile accounts, and maintain accurate records, ensuring your finances are always in order.

- Financial Reporting – Receive detailed reports, such as balance sheets, profit and loss statements, and cash flow analysis, to support data-driven decision-making.

- Payroll Management – Payroll summaries, tax filings, and employee compensation breakdowns, to support data-driven decision-making.

Through our outsourced bookkeeping services, you gain access to specialized expertise, enhanced efficiency, and the freedom to focus on expanding your business while we expertly manage your financials.

Tax compliance services

Staying compliant with HMRC regulations is crucial for every business. Our tax compliance services ensure accuracy, timely submissions, and adherence to legal standards, helping businesses avoid penalties and operate smoothly.

1. Corporation tax compliance

All UK businesses must pay corporation tax on their profits. We handle everything from tax calculations to filing, ensuring full compliance with HMRC guidelines.

- Preparation and filing of Corporation Tax (CT600) returns

- Accurate calculation of tax liabilities

- Ensuring compliance with UK corporate tax regulations

2. VAT (Value Added Tax) compliance

VAT is a key consideration for businesses that exceed the registration threshold. We manage VAT registration, returns, and compliance to ensure businesses meet HMRC obligations.

- VAT registration and de-registration assistance

- Accurate VAT return preparation and timely submissions

- Ensuring compliance with VAT schemes (Standard, Flat Rate, Margin, etc.)

3. PAYE & national insurance compliance

Employers must comply with PAYE (Pay As You Earn) and National Insurance regulations. We ensure correct payroll deductions, submissions, and compliance with employment tax laws.

- Payroll processing and tax deductions for employees

- National Insurance contributions (NIC) calculations and reporting

- RTI (Real-Time Information) submissions to HMRC

4. Capital Gains Tax (CGT) compliance

CGT applies to profits made on the sale of certain assets. Our team ensures accurate reporting and compliance with HMRC regulations.

- CGT calculations for property, shares, and business assets

- Filing CGT returns and managing payments

- Ensuring compliance with tax relief schemes

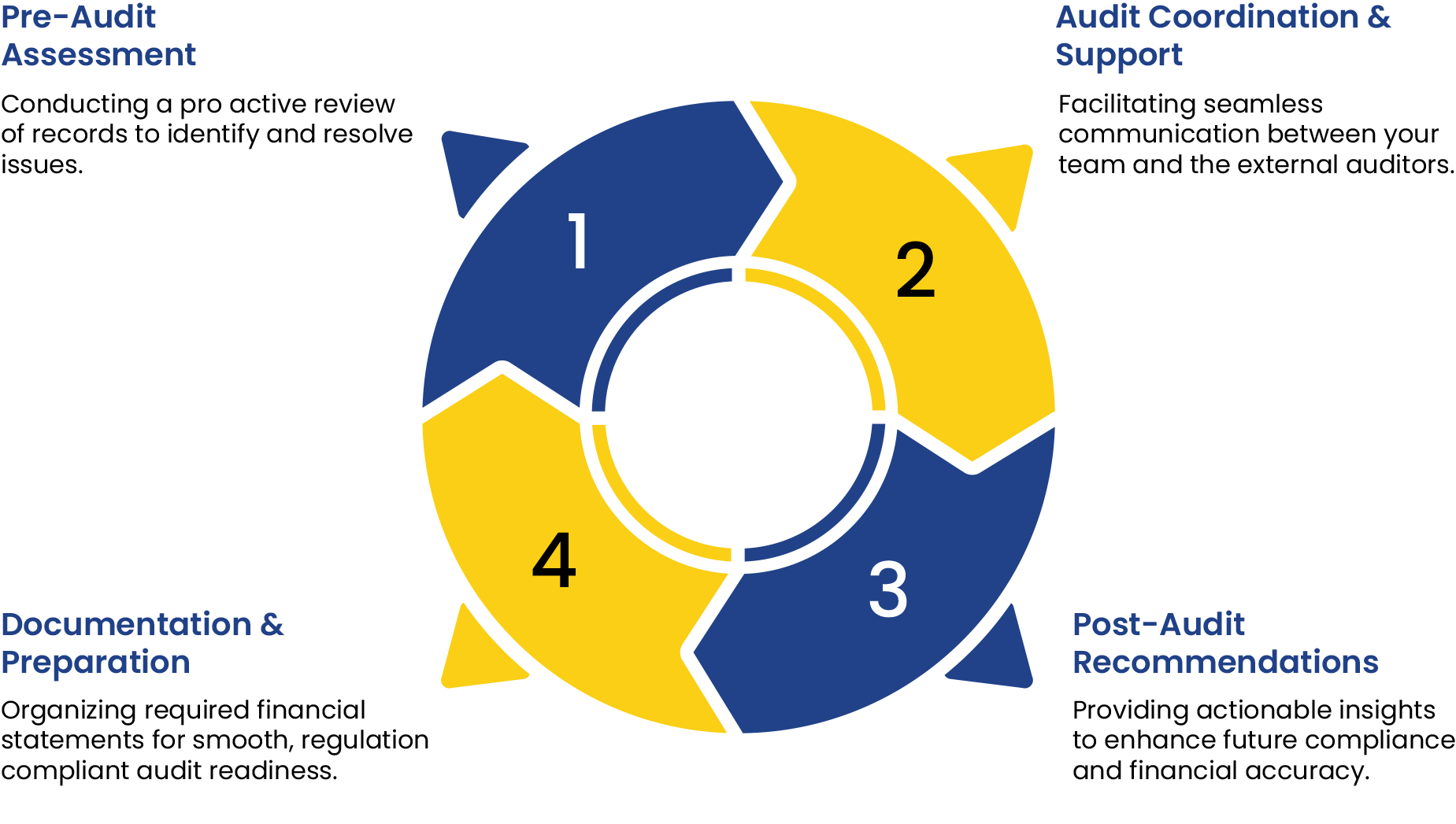

Audit support for seamless compliance

Navigating audits whether internal or external can be a complex and time-consuming process for accounting firms. At Accounting Bookkeepers, we provide expert support to ensure your firm is fully prepared and compliant. Our Audit Support services offer meticulous preparation, thorough documentation, and clear guidance, minimizing disruptions to your operations. We collaborate closely with your team to ensure accurate financial reporting, making the audit process more efficient. Whether preparing for internal assessments or external regulatory requirements, we streamline the experience, helping your firm maintain compliance and mitigate risks effectively.

Advisory services

Our advisory Services focus on enhancing operational efficiency, financial resilience, and long-term business success. We provide expert guidance on strategic planning, risk management, and financial optimization, ensuring firms have the right frameworks to scale effectively. Whether it’s improving internal processes, restructuring finances, or implementing best practices, we help firms navigate challenges with confidence.

Our advisory services extend to business growth strategies, succession planning, and compliance risk mitigation, enabling firms to operate smoothly while staying ahead of regulatory changes. By leveraging data-driven insights and industry expertise, we assist firms in making well-informed decisions that drive profitability, stability, and sustainable growth.