About us

At Accounting Bookkeepers Bermuda, we transcend traditional number-crunching to become your strategic partners in growth. Our team, led by seasoned professionals including former Big 4 partners, brings unparalleled expertise in delivering comprehensive accounting, bookkeeping, and financial management solutions to businesses across Bermuda.

With decades of combined industry experience, we simplify complex financial processes, ensure accuracy, and provide strategic insights that empower you to make informed decisions for long-term success. Utilizing advanced technologies, cloud-based tools, and deep knowledge of both US GAAP and IFRS standards, we help businesses stay compliant, efficient, and future-ready.

Whether you're a startup, mid-sized company, or a large-scale enterprise, we tailor our services to fit your unique needs allowing you to focus on scaling your business with confidence.

More About us

Smooth and secure onboarding with seamless service delivery, tailored to enhance client satisfaction.

-

Free Consultation

-

Need Assessment & Scoped Definition

-

Agreement

-

Knowledge Transfer

-

Delivery Service

Commitment to quality

Unmatched Expertise

We provide exceptional accounting and back-office services with precision and efficiency. Our skilled team ensures that every task—from tax filings to regulatory compliance—is handled with accuracy, building trust by consistently exceeding expectations. By aligning with your financial objectives, we create long-term value and measurable success for your Bermuda-based business.

Client-Centric Support

Whether it's payroll tax management or corporate compliance in Bermuda, our dedicated team offers around-the-clock support tailored to your business needs. From startups to established enterprises, we guide you in making informed decisions, minimizing risks, and ensuring full compliance with Bermuda’s local tax and regulatory framework, every step of the way.

Business Growth

Through strategic CFO advisory, seamless tech integration, and efficient bookkeeping, we empower businesses to scale rapidly in Bermuda's dynamic market. Our secure, cloud-based systems and optimized workflows maximize resources, enhancing financial performance and ensuring your business remains agile, compliant, and positioned for success in a competitive landscape.

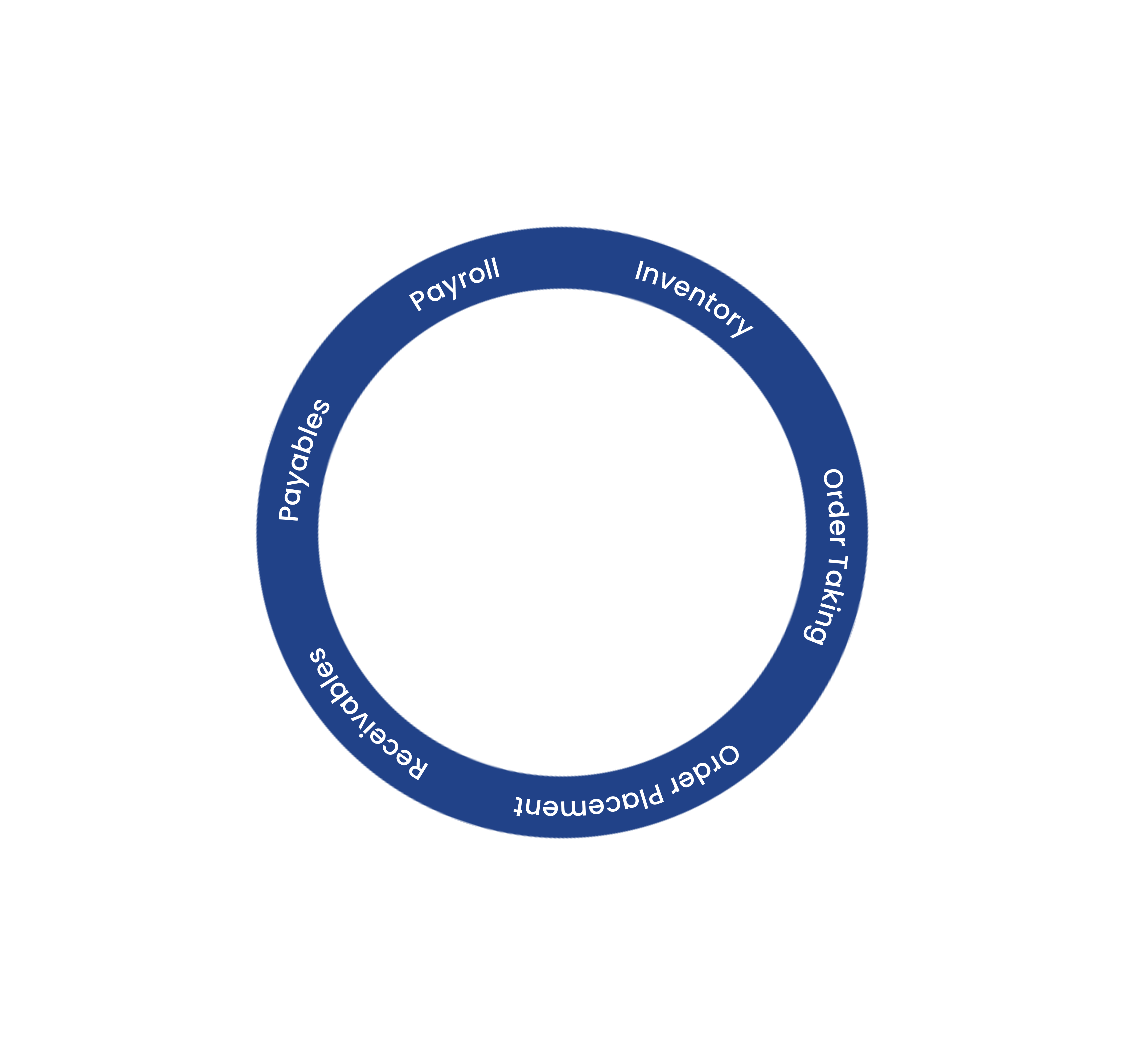

Our services

At Accounting Bookkeepers Bermuda, we offer a comprehensive range of accounting, bookkeeping, and financial advisory services designed to meet the specific needs of businesses and individuals in Bermuda. From financial reporting in compliance with Bermuda’s regulations to tax preparation and entity-specific solutions for local corporate structures, our expert team ensures precision, efficiency, and full regulatory compliance. With a focus on delivering timely insights and strategic support, we empower you to achieve your goals while staying ahead of ever-changing financial requirements in Bermuda.

Tools we use

What our clients say

Real challenges, proven solutions

Find the right plan

- Customized & flexible solutions

- Cost-efficient support services

- Project management & time savings

- Ideal for urgent and custom tasks

- Dedicated accounting, bookkeeping, and tax preparation resources

- Priority services

- Dedicated manager for managing resources & support

- Fixed resource rates

- Project management & time savings

- Task-based engagement

- Access to global talent

- Shared services model

Connect with us for personalized services

Partner with us to make informed financial decisions. Our team is here to help you streamline your bookkeeping, enhance organization, and achieve greater clarity in your financial journey.

Contact Us